Upload your accounts

Send us your PDF or Word accounts via our secure portal. We accept audited, draft or final documents.

Choose between doing it yourself with AI-powered iXBRL software or having our experts handle everything for you. Our hybrid approach combines automation and human review to deliver fast, accurate UK iXBRL, UKSEF, and ESG-compliant filings at transparent entity-based pricing, protected by a zero-risk guarantee.

Hybrid AI + Expert Review. Fixed Pricing. Zero-Risk Guarantee.

We remove the risk and complexity from digital reporting. Our hybrid AI and expert review model is built for UK iXBRL filings to Companies House and HMRC, UKSEF for listed groups, and ESG disclosures aligned with emerging global frameworks.

We convert your statutory accounts and computations into fully compliant iXBRL, validated for both Companies House and HMRC. AI‑assisted tag plus expert review.

For premium‑listed and standard‑listed issuers, we prepare and validate UKSEF/ESEF‑ready annual financial reports with correct tagging, extensions, and anchoring.

We help you structure ESG disclosures for emerging digital taxonomies and global frameworks, supporting CSRD‑style reporting, climate metrics, and sustainability KPIs.

Experience the only AI-powered iXBRL platform in the UK that lets you move seamlessly between do-it-yourself in-house iXBRL tagging and expert-managed iXBRL services. At the same cost, with no contracts or hidden fees. Quickest turnaround of less than 48 hours. Guaranteed regulator-approved filings.

Use our AI iXBRL platform, tag financial statements in-house and switch to managed service during peak season.

All your filings, whether DIY or managed, are tracked in one dashboard with consistent volume discount.

Even if you primarily use our managed service, you have full and free access to the DIY platform.

Start aniXBRL tagging yourself. If stuck, hand it off to our team mid-process. We will pick up where you left off.

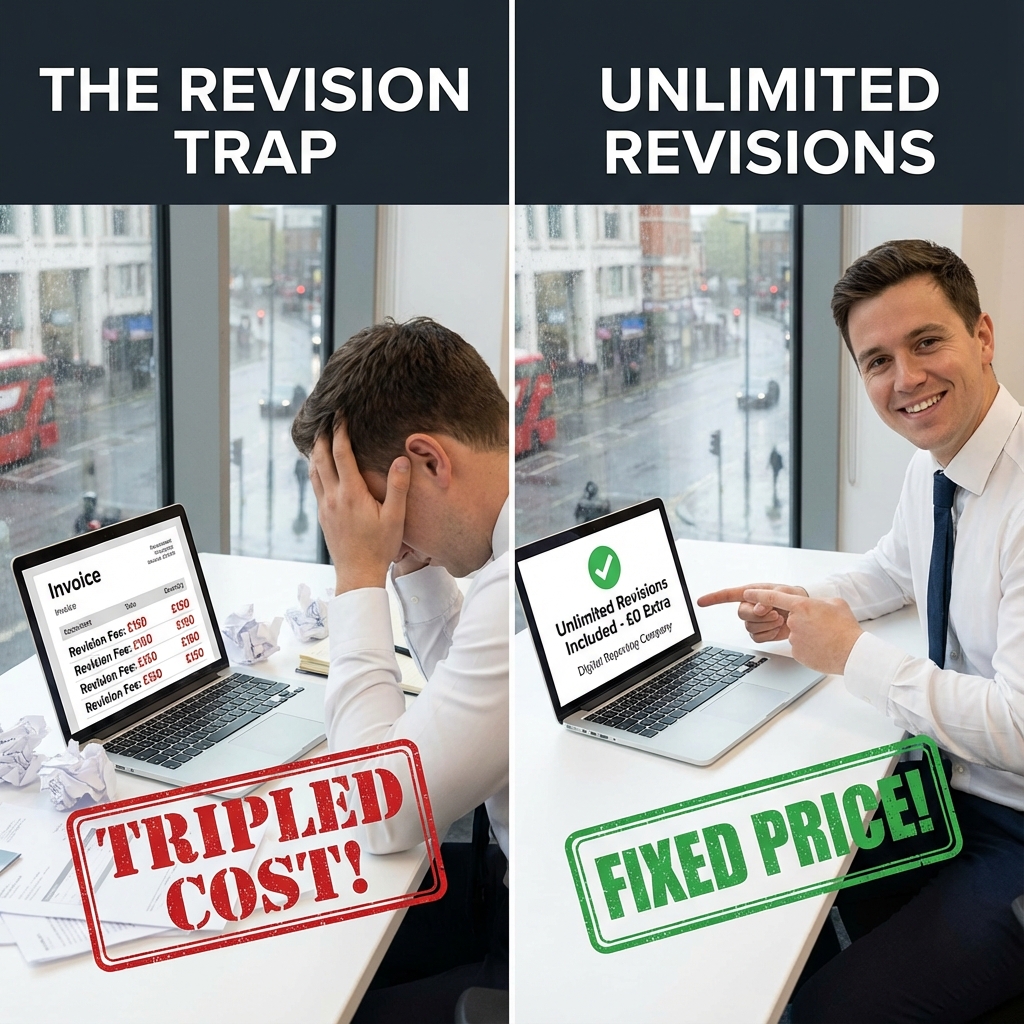

Stop unpredictable iXBRL tagging costs, revision traps, and deadline panic. Our fixed-price model and 48-hour guarantee solve the exact problems UK accounting firms and companies face with HMRC and Companies House digital filing.

Problem: Unpredictable iXBRL Cost Destroys Budgets

Traditional providers charge per page, per revision, or per "complexity level" making it impossible to budget accurately. What starts as a "simple" £200 filing can balloon to £800+ once "revision fees" and "complexity charges" are added.

Our Solution: Transparent Fixed Entity-Based Pricing

Problem: Long TAT Can Cause Late Filing & Client Complaint

Traditional providers promise "5-10 business days". UK accounting firms report 30% of iXBRL files delivered late, forcing rush work and risking HMRC and Companies House penalties.

Our Solution: Guaranteed 48-Hour TAT or Your Money Back

The Problem: Paid Revisions on Every Change

Many providers quote low initial prices, then charge additionally per revision. With HMRC’s strict validation and frequent small changes to accounts, most filings need 2–3 revisions, quietly tripling your true iXBRL cost.

Our Solution: Unlimited Revisions at No Extra Cost

Problem: HMRC Rejection for Outdated Taxonomy

HMRC updates iXBRL taxonomies annually. Many providers lag by a version or more, leading to automatic rejections, late filing penalties and extra re-submission costs. This directly impacts your compliance and can incur significant financial penalties.

Our Solution: Uptodate Taxonomy for 100% Compliance

Problem: Rush Fees During Peak Filing Season

Traditional providers charge rush fees per filing during peak season. For entities with 50+ filings, thatis about £5,000 extra fees,to meet deadline.It's like paying twice for same service.

Our Solution: Zero Rush Fees + Penalty Protection

While others take days and multiple review cycles, Digital Reporting delivers HMRC and Companies House ready iXBRL in hours.

Typical turnaround: 24–48 hours | On‑time filing rate: 99.7%+ .

Set pricing per entity and filing type. No billing by pagecount, by input file type, no hidden scope creep, no surprises.

Monitor HMRC and Companies House readiness across entities, with status, validation issues clearly surfaced.

Prepare filings in‑house using our platform or handover to our iXBRL experts if facing validation errors or in busy periods. At no additional cost.

FRC and Companies House taxonomy updates applied centrally, so filings stay compliant as regulations evolve.

Full tagging logs and validation reports to support internal review, audit queries and regulator follow‑up.

ISO 27001‑aligned controls, UK‑only processing and 99.9% platform uptime to protect sensitive statutory and tax data.

Generic tools fail ESMA quality checks. Our ESEF platform is built for IFRS reporters and regulated markets.

Designed for CFOs, financial controllers, and company secretaries of listed and regulated entities.

Verify requirements with local authorities. This is general guidance only.

Accurate tagging of IFRS primary financial statements with ESMA‑compliant anchoring and extensions.

Detailed block‑tagging and text‑block tagging for notes, policies, and disclosures to meet ESMA expectations.

Files pre‑checked against ESMA and FCA validation rules before you submit to the Officially Appointed Mechanism.

80% of tags proposed by AI, 100% reviewed by experienced ESEF specialists with IFRS expertise.

Fast ESEF conversion for late‑stage report changes, with fixed entity‑based pricing and no rush fees.

Full tagging documentation, comparison views, and change logs to support auditors and the audit committee.

Capture, verify, and report ESG data across your group for TCFD‑aligned and UK sustainability disclosures.

Built for UK‑listed companies, large private groups, and asset managers.

Verify requirements with local authorities. This is general guidance only.

Structured templates and workflows to capture environmental, social, and governance metrics across entities.

Role‑based approvals, evidence attachments, and audit trails to support internal review and external assurance.

Map disclosures to UK expectations for climate‑related reporting and to investor ESG frameworks in one place.

Track emissions, diversity, and governance metrics with drill‑downs by business unit, region, or legal entity.

Produce ESG content for annual reports, standalone sustainability reports, and investor questionnaires from one source.

Structure ESG data now for future digital submission requirements and XBRL‑based sustainability taxonomies.

No software to learn. No complex setup. Just fast, accurate iXBRL in 24–48 hours.

Send us your PDF or Word accounts via our secure portal. We accept audited, draft or final documents.

Our AI tags 80% automatically. UK XBRL specialists review every tag and validate against HMRC rules.

You receive validator-clean iXBRL files with review guide. Review online, request changes, or file directly.

Choose your level of support. Use our software yourself, get expert tagging only, or hand us everything.

Unlike per-page pricing that creates unpredictable costs, our entity based ixbrl pricing model gives you complete budget certainty, whether you're tagging one financial statement or multiple.

For micro-entities (FRS 105), typically under £632k turnover

per entity

START iXBRL now Standard 48h turnaround.For small companies (FRS 102 1A), most common for UK filings

per entity

START iXBRL now Standard 48h turnaround.For standard/full accounts (FRS 102), including detailed notes

per entity

START iXBRL now Standard 48h turnaround.Simplest accounts, typically under £632k turnover

per entity (£30 + £20 express)

START iXBRL now Express 24h turnaround.Most common, includes abridged filings

per entity (£40 + £20 express)

START iXBRL now Express 24h turnaround.Complex accounts with detailed notes

per entity (£50 + £20 express)

START iXBRL now Express 24h turnaround.Our iXBRL tagging service creates compliant files ready for you to submit. If you prefer, we can handle the actual filing with authorities for an additional fee—completely optional.

We submit your tagged CT600 corporate tax return directly to HMRC via their Government Gateway on your behalf, handling authentication and confirmation.

We file your tagged statutory accounts to Companies House electronically, ensuring compliance with all formatting and validation requirements.

Each segment has unique iXBRL filing requirements and priorities. Choose your category to see tailored solutions, specific features, and transparent pricing.

White-label iXBRL filing for 100+ clients with same-day turnaround. Scale your compliance services with transparent volume discounts, dedicated account management, and seamless integration with your existing workflows.

Bulk iXBRL filing for group companies with volume discounts. Streamline your compliance operations with batch processing, API integration, and dedicated support for high-volume clients.

Integrated iXBRL tagging with CT600 preparation. Add digital compliance to your advisory services with expert technical support, co-branded delivery, and seamless workflow integration.

Offer clients compliant, cost-effective iXBRL reporting. Streamline workflows and reduce manual effort with our automated platform and expert support.

Meet FCA, HMRC, and Companies House mandates with robust iXBRL tagging, audit trails, and transparent pricing. Ensure compliance and efficiency for all filings.

Consolidate reporting, automate tagging, and ensure compliance for all UK entities. Simplify group filings and reduce manual effort with our platform.

Affordable, easy-to-use iXBRL reporting tools, fixed pricing, and compliance with UK mandates. Designed for small and medium businesses.

File compliant reports quickly and cost-effectively, with support for all UK regulatory requirements. Designed for micro-entities and small businesses.

Fast onboarding, fixed pricing, and compliance support for digital reporting. Designed for UK start-ups and new businesses.

Meet UK reporting mandates with simple, affordable iXBRL solutions and expert support. Designed for charities and non-profits.

File compliant nil returns with minimal effort and cost. Designed for dormant companies and entities with no trading activity.

Automate digital reporting, meet UK mandates, and manage complex entity structures with ease. Designed for universities and educational institutions.

Simple, affordable digital reporting tools and compliance support. Designed for sole traders and partnerships in the UK.

Automated iXBRL tagging, compliance, and transparent pricing for all UK reporting needs. Designed for LLPs and partnership structures.

White-label iXBRL filing for 100+ clients with same-day turnaround. Scale your compliance services with transparent volume discounts, dedicated account management, and seamless integration with your existing workflows.

Bulk iXBRL filing for group companies with volume discounts. Streamline your compliance operations with batch processing, API integration, and dedicated support for high-volume clients.

Integrated iXBRL tagging with CT600 preparation. Add digital compliance to your advisory services with expert technical support, co-branded delivery, and seamless workflow integration.

Offer clients compliant, cost-effective iXBRL reporting. Streamline workflows and reduce manual effort with our automated platform and expert support.

Streamlined iXBRL reporting for public companies with regulatory compliance. Meet FCA and Companies House requirements with automated tagging and expert validation.

Consolidated iXBRL reporting for corporate groups with parent-subsidiary relationships. Ensure compliance across all entities with unified reporting and expert oversight.

Affordable, easy-to-use iXBRL reporting tools, fixed pricing, and compliance with UK mandates. Designed for small and medium businesses.

File compliant reports quickly and cost-effectively, with support for all UK regulatory requirements. Designed for micro-entities and small businesses.

Simple, affordable iXBRL compliance for new companies. Get started with digital reporting from day one with our startup-friendly pricing and support.

Specialized iXBRL reporting for charitable organizations with SORP compliance. Meet Charity Commission requirements with tailored reporting solutions.

Automated dormant company filings with minimal effort. Maintain compliance with HMRC and Companies House requirements at fixed, predictable costs.

Specialized iXBRL reporting for higher education institutions. Meet HEFCE and regulatory requirements with university-specific compliance solutions.

Simple iXBRL compliance for self-employed individuals and partnerships. Meet UK filing requirements with straightforward, cost-effective solutions.

Automated iXBRL tagging, compliance, and transparent pricing for all UK reporting needs. Designed for LLPs and partnership structures.

Validator-clean iXBRL in 24–48 hours — 99.8% first-time acceptance across 500+ UK companies.

Traditional providers charge by the page and take weeks. DIY software requires training and still leaves room for errors. We deliver validator-clean iXBRL in 24–48 hours with transparent pricing and zero filing risk.

What makes us different:

Trusted — 99.8% first-time acceptance across 500+ UK companies

Free quote • No obligation • Response in 2 hours

DigiRep is a leading UK-based provider of iXBRL tagging, digital accounts, and Companies House filing solutions. Our expert team combines deep accounting knowledge with advanced technology to ensure your financial reports are accurate, compliant, and delivered on time—every time. We help businesses, accountants, and advisors navigate complex HMRC and FRC requirements with confidence. Trusted by 2,000+ UK clients for speed, accuracy, and compliance.

Our Services

From SMEs to listed companies, accountancy firms to charities—compliant iXBRL for all UK entities

Everything you need to know about digital reporting requirements, filing processes, and compliance solutions for UK businesses and accounting firms.

iXBRL (Inline eXtensible Business Reporting Language) is a digital format that embeds structured, machine-readable tags into your company accounts—making them readable by both humans and HMRC/Companies House systems.

Why mandatory? Since 2011, HMRC requires iXBRL for Corporation Tax returns. From 2027, Companies House mandates fully tagged iXBRL for all statutory accounts (Economic Crime and Corporate Transparency Act 2023).

Benefits: Faster processing, fewer errors, automatic validation, and compliance with UK digital reporting requirements. Non-compliance risks penalties up to £1,500 per late filing.

Yes, if you file Corporation Tax returns to HMRC (mandatory since 2011). From 2027, all UK companies filing statutory accounts to Companies House must use fully tagged iXBRL.

Who needs iXBRL now:

Exemptions: Sole traders and partnerships filing Self Assessment don't need iXBRL (yet). However, accountancy practices often prepare iXBRL for efficiency.

XBRL is a standalone XML file with structured data—machine-readable but not human-readable. iXBRL (Inline XBRL) embeds the same structured tags into your PDF/HTML accounts—readable by both humans and machines.

Key differences:

| iXBRL | XBRL | |

|---|---|---|

| Human-readable | ✓ Yes | ✗ No |

| Machine-readable | ✓ Yes | ✓ Yes |

| UK requirement | ✓ HMRC, Companies House | ✗ Not accepted |

| File format | HTML/PDF with tags | XML only |

UK standard: HMRC and Companies House require iXBRL, not standalone XBRL. Listed companies use ESEF (European Single Electronic Format), which is also iXBRL-based.

The FRC (Financial Reporting Council) taxonomy is the official UK dictionary of accounting terms and tags used in iXBRL filing. It defines how to tag every line item in your accounts—from turnover to deferred tax.

Why it matters: HMRC and Companies House only accept iXBRL files tagged with the latest FRC taxonomy. Using outdated taxonomy causes validation errors and filing rejections.

Updates: FRC releases new taxonomy versions annually (usually January). Digital Reporting (UK) automatically updates to the latest taxonomy—you never file with outdated tags.

Common mistake: DIY software or outdated tools use old taxonomy versions, causing 40%+ rejection rates. We guarantee validator-clean output with current FRC taxonomy.

You can try DIY software (e.g., free HMRC tools, accounting software add-ons), but most companies use specialists to avoid errors, rejections, and penalties.

DIY challenges:

Specialist benefits: 99.8% first-time acceptance, 24-48 hour turnaround, always-current taxonomy, unlimited revisions, and zero-risk guarantee.

Cost comparison: DIY "free" tools cost 6-8 hours of your time (£300-£600 opportunity cost) vs. £XXX fixed price with guaranteed acceptance.

Rejection consequences: You must fix errors and re-file before the deadline. Late filing penalties: £100 (1 day late), £200 (3 months), £500 (6 months), up to £1,500 for persistent delays.

Common rejection reasons:

Our guarantee: If HMRC or Companies House rejects your iXBRL file due to our error, we provide full refund + free re-filing—no questions asked.

Track record: 99.8% first-time acceptance rate across 500+ UK companies—independently verified by client audits.

Simple 3-step process—24-48 hour turnaround:

Step 1: Upload your accounts (5 minutes)

Upload PDF/Word accounts via secure portal. We accept all formats: audited accounts, management accounts, draft financials.

Step 2: We tag and validate (24-48 hours)

AI-assisted tagging + UK XBRL specialists review. We validate against HMRC/Companies House requirements and latest FRC taxonomy.

Step 3: Review and file (same day)

You receive validator-clean iXBRL file + audit documentation. File directly to HMRC/Companies House or we can file on your behalf.

Optional: Unlimited revisions until perfect. If you spot errors or need changes, we fix them same-day at no extra cost.

Standard turnaround: 24-48 hours from upload to validator-clean iXBRL file. Most filings completed within 36 hours.

Turnaround by complexity:

Rush service: Same-day completion available for urgent deadlines (e.g., filing due tomorrow)—no extra charge.

Comparison: Traditional per-page providers take 1-2 weeks. DIY software takes 4-8 hours of your time. We deliver in 24-48 hours with 99.8% acceptance rate.

We accept all common formats:

Quality requirements: Documents must be readable (not blurry or corrupted). If using scanned documents, ensure text is clear and legible.

Security: All uploads encrypted (TLS 1.3), stored in UK-only servers (GDPR compliant), and deleted after 90 days (or per your retention policy).

Both options available:

Option 1: We provide the iXBRL file (most common)

You receive validator-clean iXBRL file + audit documentation. You file directly to HMRC/Companies House using your own credentials.

Option 2: We file on your behalf (optional)

We file directly to HMRC/Companies House using your agent authorization. You receive filing confirmation + reference numbers.

What's included in both options:

Agent authorization: If we file on your behalf, you authorize us as your agent via HMRC/Companies House portals (standard 64-8 form or Companies House authorization).

Unlimited revisions included—no extra cost, no questions asked. We fix errors or make changes until you're 100% satisfied.

Common revision scenarios:

Revision turnaround: Same-day for minor changes (e.g., single figure correction), 24 hours for major changes (e.g., full re-tagging).

No hidden costs: Revisions included in fixed price—whether you need 1 revision or 10 revisions.

Yes—we handle all UK entity types with same transparent pricing and fast turnaround:

Group accounts:

Charities:

LLPs (Limited Liability Partnerships):

Other entity types:

Pricing: Fixed price per entity—same transparent pricing model regardless of complexity. Contact us for group account quotes.

Fixed price per entity—not per page. You know the exact cost before we start, whether your accounts are 10 pages or 100 pages.

Transparent pricing:

What's included: Full iXBRL tagging, HMRC/Companies House validation, unlimited revisions, audit-ready documentation, same-day support, and zero-risk guarantee.

Savings vs. per-page providers: £XXX fixed vs. £600+ (£12/page × 50 pages) = save 40-65% + get 24-48 hour turnaround vs. 1-2 weeks.

Predictable costs, no surprises. Per-page pricing penalizes detailed disclosures and creates perverse incentives to minimize transparency.

Problems with per-page pricing:

Fixed pricing benefits:

Example: 50-page accounts cost £XXX fixed vs. £600+ per-page (£12/page) = save £XXX (XX%) + faster turnaround.

If HMRC or Companies House rejects your iXBRL file due to our error, we provide full refund + free re-filing—no questions asked.

What's covered:

What's not covered:

How it works: If rejected, send us the rejection notice. We investigate within 24 hours. If our error, we issue full refund + re-file for free within 48 hours.

Track record: 99.8% first-time acceptance rate—only 2 rejections per 1,000 filings, both resolved within 24 hours at no cost to clients.

Zero hidden costs. Fixed price includes everything—no rush fees, no revision charges, no "complex page" surcharges.

What's included in fixed price:

Optional extras (clearly disclosed):

Comparison: Per-page providers charge extra for "complex pages" (£15-£20/page), rush service (50% surcharge), and revisions (£50-£100 each). We include everything in fixed price.

Yes—volume discounts for accountancy practices and multi-entity groups:

Accountancy practice volume plans (20+ clients annually):

Additional practice benefits:

Multi-year discounts:

Example savings: Practice with 85 clients saves £27K annually (30% discount) vs. per-page providers—plus faster turnaround and priority support.

Flexible payment options:

Standard payment (most common):

Accountancy practice payment terms:

Multi-year payment plans:

Security: All payments processed via secure, PCI-DSS compliant payment gateway. We never store your card details.

ESEF (European Single Electronic Format) is the EU-mandated digital reporting format for listed companies. UK listed companies use UKSEF (UK Single Electronic Format), which is ESEF-aligned but adapted for UK regulations.

Who needs ESEF/UKSEF:

Requirements:

Deadline: File within 4 months of year-end (same as annual report deadline). FCA enforces compliance—non-compliance risks regulatory action.

ESEF is more complex and comprehensive than standard UK iXBRL:

| ESEF/UKSEF | Standard iXBRL | |

|---|---|---|

| Taxonomy | IFRS Foundation | FRC (UK GAAP) |

| Tagging scope | Primary statements + notes | Accounts only |

| File format | XHTML (full annual report) | HTML/PDF (accounts) |

| Validation | ESMA validator | HMRC/Companies House |

| Regulator | FCA (UK), ESMA (EU) | HMRC, Companies House |

| Complexity | High (200+ tags typical) | Medium (50-100 tags) |

Additional ESEF requirements:

Why it matters: ESEF errors cause regulatory scrutiny, investor confusion, and potential FCA enforcement action. We guarantee ESMA validator-clean output.

Same-day turnaround available for urgent deadlines. Standard turnaround: 36-48 hours for full ESEF tagging + validation.

Turnaround by scope:

Why so fast? Hybrid AI + expert review—AI handles 80% of tagging, UK XBRL specialists review 100% for accuracy and compliance.

Comparison: Big Four charge £5,000-£15,000 and take 2-4 weeks. We deliver in 36-48 hours at £XXX fixed price with same quality.

Yes—100% ESMA validator-clean output guaranteed. We validate against all ESMA requirements before delivery.

ESMA validation checks:

What you receive:

Zero-risk guarantee: If FCA or ESMA rejects your ESEF file due to our error, full refund + free re-filing within 24 hours.

Fixed price per entity: £XXX (primary statements + block tagging). Full detailed tagging: £XXX.

What's included:

Savings vs. Big Four:

Why cheaper? Hybrid AI + expert review (80% automation) vs. 100% manual tagging. Same quality, fraction of the cost.

Yes—we tag ESG disclosures in ESEF format for UK and EU listed companies preparing for digital ESG reporting mandates.

ESG tagging scope:

Current status: ESG tagging standards still evolving. We use IFRS Sustainability Disclosure Taxonomy (ISSB) and ESRS XBRL taxonomy where applicable.

Future-ready: As FCA/ESMA mandate digital ESG reporting (expected 2025-2027), we'll automatically update to required taxonomies—you won't need to change providers.

Pricing: ESG tagging included in ESEF price for basic disclosures. Complex ESG reports (50+ pages): custom quote.

Yes—accountancy practices are our largest client segment. We serve 100+ UK practices from sole practitioners to Top 50 firms.

Why practices choose us:

Practice benefits:

Case study: Mid-tier practice (85 clients) saved £27K annually + freed 50 hours/month by outsourcing iXBRL to us vs. DIY software.

Tiered volume discounts—the more clients, the bigger the savings:

| Annual clients | Discount | Price per filing | Annual savings |

|---|---|---|---|

| 1-19 clients | 0% | £XXX | — |

| 20-49 clients | 20% | £XXX | £X,XXX |

| 50-99 clients | 30% | £XXX | £XX,XXX |

| 100+ clients | 40% | £XXX | £XX,XXX+ |

Additional benefits for volume clients (50+ clients):

How it works: Commit to minimum annual volume (e.g., 50 clients), get discount on all filings. If you exceed volume, discount increases automatically.

Yes—white-label options available for practices with 50+ clients annually. Deliver iXBRL services under your branding, we stay invisible.

White-label features:

Benefits:

Pricing: White-label setup fee £XXX (one-time) + standard volume discounts apply.

Requirements: Minimum 50 clients annually, 12-month commitment. Custom integrations available for 100+ clients.

Bulk upload portal for practices—upload 10-50 clients in one session:

How it works:

Time savings: Upload 50 clients in 10 minutes vs. 2-3 hours uploading individually.

Advanced features (100+ clients):

Setup: Bulk portal access included for all volume clients (20+ clients). API integration available for 100+ clients (setup fee applies).

Flexible payment terms designed for practice cash flow:

Monthly invoicing (most common):

Annual pre-payment (save 10-15%):

Per-client billing (smaller practices):

Example: Practice with 85 clients pays £XX,XXX monthly (30-day terms) or £XX,XXX annually (pre-pay, save 10%).

Simple 3-step onboarding—start filing within 24 hours:

Step 1: Free consultation (15 minutes)

Book a call to discuss your practice size, client mix, and volume. We'll recommend the best plan and pricing.

Step 2: Setup (same day)

We create your practice account, set up bulk upload portal, and configure payment terms. You receive login credentials and onboarding guide.

Step 3: Trial filing (free)

Upload 1-3 client accounts for free trial. We deliver iXBRL files within 24 hours. If satisfied, activate your volume plan.

What you get:

No commitment: Cancel anytime, no long-term contracts (except white-label requires 12-month commitment).

Bank-grade security—ISO 27001 certified, GDPR compliant, UK-only data processing.

Security measures:

Certifications & compliance:

Confidentiality: All staff sign NDAs, background-checked, trained on data protection. We never share client data with third parties.

Yes—full compliance with UK GDPR and EU GDPR. We're registered with the UK Information Commissioner's Office (ICO).

GDPR compliance measures:

UK-only processing:

Documentation: DPA, privacy policy, data retention policy, and security documentation available on request.

Automatic secure deletion after 90 days (or per your custom retention policy).

Data lifecycle:

Custom retention policies:

What's deleted: Source files (PDF/Word accounts), iXBRL files, audit documentation, metadata. We retain anonymized usage statistics only (for service improvement).

Verification: Deletion certificates available on request (confirms secure deletion with timestamp).

Yes—£5 million professional indemnity insurance covering errors, omissions, and negligence in iXBRL tagging services.

Coverage includes:

Insurer: Hiscox (A-rated, specialist professional indemnity insurer)

Policy details:

Certificate of insurance: Available on request for due diligence, tender submissions, or client audits.

Hybrid AI + expert review—80% AI automation, 100% human verification.

How it works:

Why hybrid?

Team: 12 UK XBRL specialists (ACA/ACCA qualified accountants + XBRL certification), supported by proprietary AI platform.

Automatic taxonomy updates—you never file with outdated tags.

How we stay current:

Proactive communication:

Industry engagement:

Your benefit: Zero effort required—we handle all regulatory tracking, taxonomy updates, and compliance changes. You always file with current requirements.

Disclaimer: This FAQ provides general guidance on UK iXBRL, ESEF, and ESG reporting requirements. Regulations change frequently—always verify current requirements with HMRC, Companies House, FCA, or your professional advisor. Digital Reporting (UK) is not a regulated accounting or legal advisory firm. We provide technical iXBRL tagging solutions only.

See how UK businesses, accountancy practices, and listed companies achieved HMRC-compliant iXBRL filing in 24-48 hours with transparent pricing and zero rejections.

Fixed pricing. Expert support. Fast delivery.

We deliver three solutions: iXBRL filing, UKSEF compliance, and ESG reporting. Our team responds to your questions within 30 minutes during business hours (Mon–Fri, 09:00–17:30).

40–60% lower cost. 30-minute support response. 48-hour delivery.